7 Key Use Cases for Insurance Chatbots

In the insurance market, things get tricky.

Choosing the right insurance is a complex decision. Having competitive prices is just the tip of the iceberg; insurance companies work on the basis of promises and need to earn the customers’ trust that they’ll deliver on those promises.

Not to mention that insurance is a tailored product. What works for one customer won’t work for the next. Under these conditions, clear communication is vital. If you can explain your plans more quickly and clearly than your competitors through personalized communication, you’ll put your business at an advantage.

That’s why chatbots are a unique solution for this approach. You can offer immediate, convenient and personalized assistance at any time, setting your business apart from other insurance agencies.

- What is an insurance chatbot?

- Benefits of using an insurance chatbot

- 7 powerful insurance chatbot use cases

- 3 examples of insurance chatbots

- Userlike’s AI and chatbot solutions for insurance

What is an insurance chatbot?

An insurance chatbot is artificial intelligence (AI)-powered software designed to interact with users and provide instant assistance and information about insurance-related topics. It uses natural language processing (NLP) to understand user inquiries and respond appropriately.

Insurance chatbots can be used on different channels, such as your website, WhatsApp, Facebook Messenger SMS and more. It can streamline and enhance customer interactions by providing instant support, answering frequently asked questions, assisting with policy inquiries, generating insurance quotes, and even starting the claims process.

Benefits of using an insurance chatbot

- Cost efficient. An insurance chatbot can handle any amount of inquiries at any time. This saves your business from having to hire more agents if you’d like to provide support on the weekends, for example. In terms of price, a chatbot solution like Userlike’s costs just 8% of an average agent salary and can take over 30% of the workload.

- Scalable. Chatbots can effortlessly scale to handle a large number of conversations at one time without delays or performance issues. If you’re running a special promotion, for example, a chatbot can help with traffic spikes to your website or during peak periods.

- Consistent and accurate. Insurance chatbots are programmed to provide consistent and accurate information based on a predefined knowledge base. This reduces the risk of human error and makes sure customers receive reliable, consistent and up-to-date information.

- Increases customer engagement. Even though chatbots have been around since the 1980s, they’re still considered a bit of a novelty. Not to mention they’re getting smarter and more capable of handling a wide array of inquiries. With an insurance chatbot, you can increase customer engagement by proactively reaching out to visitors on an interactive and conversational interface.

- Collects data and insights. An insurance chatbot helps grow your customer base by collecting data, which provides you with a better overview of their preferences, behavior and pain points. This data is great for improving your business’ products and services, streamlining the application and claims process and focusing your customer targeting efforts.

7 powerful insurance chatbot use cases

- Ask questions to help choose an insurance plan

- Explain insurance plans in simple terms

- Automatically process claims

- Cover policy details and answer questions

- Collect more applications and qualify customers

- Assist customers with insurance payments

- Receive feedback on your plans and customer service

1

Ask questions to help choose an insurance plan

Chatbots can help make purchasing insurance a casual affair. Your business can set itself apart by using automation to simplify an otherwise tedious search process.

A proactive chatbot can greet your customers and offer to answer any questions they may have about claims, coverage, regulations and more. Likewise, it can ask your customers questions about their lifestyles to help determine the right plan — such as their age, occupation, travel frequency, and any risk factors.

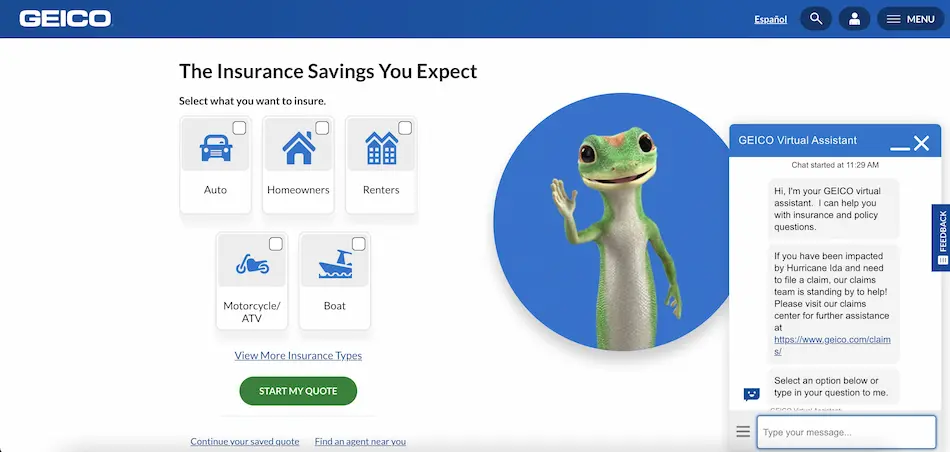

For example, Geico uses its virtual assistant to greet customers and offer to help with insurance or policy questions. The user can then either type their request or select one from a list of options.

Userlike’s AI features make it easy to set this up. Our AI chatbot uses information from a central knowledge base full of your business data to assist customers. This knowledge base also powers your FAQ pages and contact forms so answers stay consistent across your customer communication pages.

Geico also uses its chatbot to help customers get a policy quote, make a payment or get ID cards, likely their most popular requests.

We recommend using a customer messaging solution like Userlike to start learning what your customers need, and give them the right answers instantly.

2

Explain insurance plans in simple terms

A chatbot is a great tool for clearly explaining your insurance plans. You can use a bot to ask qualifying questions to learn the customer’s needs before recommending plans.

For example, you could create scripts for each plan so that your chatbot can do a comprehensive price breakdown. This would be a transparent way to show customers what they’re getting for the price and how much is covered depending on the need or accident.

Many sites, like TARS, offer pre-made insurance chatbot templates so you don’t need to start from scratch when creating your scripts. You can focus on editing it to include your insurance plan information and not worry about setting up logic.

Chatbots are extensions of your team, but customers don’t need to give them their full attention like they would with an agent.

When translating your insurance plans into chatbot scripts, consider adopting a casual, conversational approach. In Allstate’s FAQ page, questions are phrased how a customer would ask them:

If Allstate started using a chatbot, they could easily use this page to write simple and helpful scripts to help customers across their website. This saves customers having to click away from your plans to find the contact page.

3

Automatically process claims

In insurance, customers value speed. The time consuming process of submitting and processing claims and waiting for a response can be easily mitigated by a chatbot.

According to Statista, only five percent of insurance companies said they are using AI in the claims submission review process and 70% weren’t even considering it.

When you consider how chatbots and automation can help, this number seems ludicrous. Chatbots can detect inconsistencies in a claim, report fraudulent details and reduce the processing times for validating death certificates by cross referencing government websites.

“By starting with deep industry expertise and AI-based tools, companies will benefit from increased speed, accuracy and efficiency. Further, the increased productivity opens up more time for insurers to develop the personal connections customers are looking for when making insurance decisions.” - Yoann Michaux for IBM

According to IBM, robotic process automation in insurance can speed up claims processing since it can move large amounts of claim data with just one click. Traditional claims processing requires employees to manually gather and transfer information from multiple documents.

With a customer messaging solution like Userlike, your customers can upload media within the chat (for example, pictures of the damage), which your AI chatbot can then quickly and easily forward to an agent for processing. Handovers are also possible at any time just in case customers need immediate human assistance.

The ultimate chatbot guide for businesses

Learn how chatbots work, what they can do for you, how to create one - and if bots will steal our jobs.

Download for free

4

Cover policy details and answer questions

Customers may have specific policy requirements, or just want to compare what your business offers to your competitors.

For insurance and legal jargon, you can use button options or keyword recognition so customers can learn more about difficult topics and terms. For example, you could display button options within the chat to help guide the conversation.

You could use such button options during policy explanations so customers can learn more about what you offer.

For example, your chatbot can skip covering the conditions of a policy and instead give the customer the chance to select if they would like to hear more about it. This puts the customer in control and lets them learn about the aspects that matter most to them.

5

Collect more applications and qualify customers

Visitors are likely comparing your insurance to other companies’, so you have to get their attention. This is where live chat and chatbots prosper; you can proactively approach more potential customers directly on your website to create leads.

With Userlike, you can ask for an email address before the customer even begins the chat. Then your chatbot can take care of the rest of the lead generation process : stoking interest, converting the customer and leading to a sale and/or forwarding to an agent to complete a transaction.

You can even have your chatbot send forms and downloadable content directly within the chat. That way your customer doesn’t have to search your website for what they need.

Your chatbot can then take all the necessary steps to qualify your customers and only push the serious ones through to your agents.

If you haven’t done it yet, we also highly recommend using our post “4-step formula for calculating your chatbot ROI” to determine how much you can save and earn by using a chatbot. This will also help you determine how many customers you could earn per month.

6

Assist customers with insurance payments

At the German insurance agency LVM , they use live chat to respond to customers asking for the status of their damage claim.

A chatbot can assist with this process by collecting the customer’s user ID and question to help forward the request to an agent, or share the status of their claim.

According to our chatbot survey, “What do your customers actually think about chatbots?” almost 40% of customers are also comfortable making payments using a chatbot.

A chatbot can also help customers inquire about missing insurance payments or to report any errors. A chatbot can either then offer to forward the customer’s request or immediately connect them to an agent if it’s unable to resolve the issue itself.

A chatbot can also help customers close their accounts and make sure all charges are paid in full.

7

Receive feedback on your plans and customer service

Giving feedback to a business takes time and effort. When a customer has their inquiry covered, why stick around a few minutes more to answer questions?

Chatbots help you cleverly collect feedback directly in the chat box. It can be as simple as showing button options or asking your customer to leave a few words about their experience at the end of the chat.

Or you can have your chatbot automatically send a survey through email or directly in the chat box after the conversation ends.

Plus it’s important to know how your chatbot is doing so you can monitor its performance and make any necessary improvements. With Userlike, our chatbot shows a five-star rating system at the end of every chatbot conversation. Customers can also leave written feedback, and agents can use the chatbot’s transcripts to see how the conversation went.

3 examples of insurance chatbots

Zurich

Zurich Insurance uses a Claims Bot on their car and home insurance claims guidance pages. The Claims Bot asks the user a series of questions before either guiding the user to the appropriate pages or connecting them with an available agent.

Though the Claims Bot is a rule-based chatbot solution, it helps narrow down the user’s immediate need so that they get the specialized assistance they need.

Users can choose to either type their request or use the provided button-based menu in the chat. Getting connected to an agent is quick and painless, which we learned is especially important to consumers when using a chatbot.

AXA

AXA actually provides two chatbots: Emma, an in-app chatbot for existing customers and their AXA Chat.

Emma provides more personal services, such as a symptom checker, to app users. However, it’s regionally locked and not as accessible as their AXA Chat. AXA links their chatbot on their Private Customers page and it opens in a new window.

Users can either select the topic they’re interested in from a button menu or type their request directly. AXA Chat asks the user what they need help with, offers explanations of difficult topics and links relevant pages.

AXA has an extensive website, so using a chatbot to help users find exactly what they’re looking for is a clever, sales and customer-focused way of offering assistance.

Aviva

Repetitive questions are inevitable for insurance businesses. That’s why companies like AVIVA have an entire page dedicated to answering common questions about coverage, quotes, claims and more.

But a unique aspect of their page is a bold banner advertising their chatbot as an instant support channel.

This is a great example of how to advertise your chatbot. No one wants to invest time and effort into designing conversation flows just for a user to click your bot away. Plus it clearly states the benefit: “Get support straight away.”

Like in the other examples, AVIVA uses a blend of button options and typed inquiries to help customers. It’s a simple setup, but effective at helping the customer find the pages and contact information they need quickly.

Userlike’s AI and chatbot solutions for insurance

Userlike helps you make your chatbot an integral part of your insurance team. We are a truly all-in-one solution with AI features you won’t find with many other providers.

Our AI Automation Hub is part of our customer messaging solution, so all of your chatbot’s customer conversations and controls are in one place. You can choose your routing mode, design your script flow and personalize your AI bot all within our software.

There’s no need to connect to a third party chatbot provider — everything you need is already available.

The AI chatbot learns from its conversations over time, which improves the quality of its answers and grows your insurance knowledge base. It’s a powerful first line of contact for your customers and can take over repetitive tasks from your agents, such as answering frequently asked questions, collecting customer info and assisting with account management and payments, just to name a few.

In addition to our AI chatbot, we offer a Smart FAQ and Contact Form Suggestions that attempts to answer a customer’s question as they type, saving them and your agents time.

The Smart FAQ is a responsive self-service portal that helps customers resolve their issues quickly. You can pin popular insurance topics to the top and ensure that customers receive consistent answers with every search.

Contact Form Suggestions attempts to answer the customer’s question before they write to your team. This reduces redundant inquiries, freeing up your agents’ time.

Both features use auto-completion to answer customer questions as they’re typing them, saving time and effort.

And the best part - the AI Automation Hub doesn’t require a developer or IT experience to set it up.

If you’re interested in our sophisticated AI features, start a chat on our website to talk to a member of our team or email us at support@userlike.com. And if you’re in need of a high quality customer messaging solution, try our 14-day trial for free, no strings attached.